dc income tax withholding calculator

Determine the dependent allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

Why Is There Federal Withholding On My Savings Account Quora

The unemployment wage base for the District of Columbia is 9000 for 2022.

. Overview of District of Columbia Taxes. The amount of income tax your employer withholds from your regular pay depends on two things. 2015 Income Tax Withholding Instructions and Tables.

If you are not liable for DC income taxes because you are a nonresident or military spouse you must file Form D-4A Certifi cate of Non-residence in the District of Columbia with your employer. Isnt technically a state unfortunately youre still responsible for paying State Unemployment Insurance SUI. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Find your income exemptions. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Overview of District of Columbia Taxes.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Capital has a progressive income tax rate with six tax brackets ranging from 400 to 1075. After a few seconds you will be provided with a full breakdown of the tax you are paying.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. The District of Columbia income tax has six tax brackets with a maximum marginal income tax of 895 as of 2022. D-4 and file it with his her employer.

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. For help with your withholding you may use the Tax Withholding Estimator. In the past auditors manually.

2011 Income Tax Withholding Instructions and Tables. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Find your gross income.

State Unemployment Insurance ranges from 19 to 74 and is 27 for a new employer. 20002 District of Columbia INCOME TAX WITHHOLDING Instructions and Tables 2010 New Withholding Allowances for the Year 2010 The tables reflect. For employees withholding is the amount of federal income tax withheld from your paycheck.

Calculate your Washington DC net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington DC paycheck calculator. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. District of Columbia Income Tax Table Tax Bracket Single Tax Bracket Couple Marginal Tax Rate.

Tax Information Sheet Launch District of Columbia Income Tax Calculator 1. To use our district of columbia salary tax calculator all you have to do is enter the. DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in District of Columbia. Has relatively high income tax rates on a nationwide scale. The information you give your employer on Form W4.

Every 4 weeks Once a Month Twice a Month Every 2 Weeks Every Week Other. Unemployment Insurance SUI Even though DC. See withholding on residents nonresidents and expatriates.

How to Calculate 2021 District of Columbia State Income Tax by Using State Income Tax Table. Has relatively high income tax rates on a nationwide scale. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

In 2005 the Office of Tax and Revenue OTR began to automatically charge a penalty for underpayment of estimated tax by any person financial institution or business. Which you are responsible for as an employer but not as an employee. Paid by the hour.

For employees withholding is the amount of federal income tax withheld from your paycheck. Office of Tax and Revenue 941 North Capitol Street NE. Capital has a progressive income tax rate with six tax brackets ranging from 400 to.

To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 2013 Income Tax Withholding Instructions and Tables. Dependent Allowance 1775 x Number of Dependents.

This change took effect January 1 2005 for tax year 2004 returns. Supports hourly salary income and multiple pay frequencies. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details.

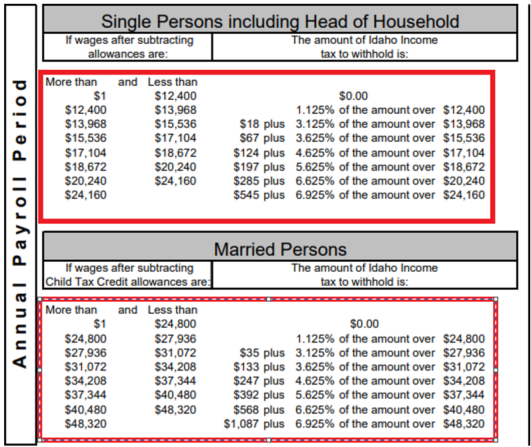

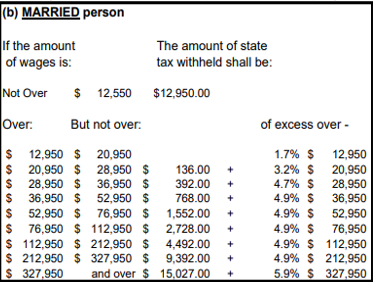

Income tax brackets are the same regardless of filing status. Apply the taxable income computed in step 5 to the following tables. The amount you earn.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Not expect to owe any DC income tax. Pay Periods per Year.

DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ. For Payroll in Tax Year. And I qualify for exempt status on federal Form W-4.

Switch to Washington DC hourly calculator. 20002 District of Columbia INCOME TAX WITHHOLDING Instructions and Tables 2010 New Withholding Allowances for the Year 2010 The tables reflect withholding amounts in dollars and cents. 2017 Income Tax Withholding Instructions and Tables.

Find your pretax deductions including 401K flexible account contributions. Check the 2021 District of Columbia state tax rate and the rules to calculate state income tax. 2012 Income Tax Withholding Instructions and Tables.

OTR will charge 10 percent interest compounded daily on any underpayment of estimated taxes. Every new employee who resides in DC and is required to have DC income taxes withheld must fi ll out Form. 2014 Income Tax Withholding Instructions and Tables.

Instead the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine. 2018 income tax withholding instructions and tables. Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages.

This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Use tab to go to the next focusable element. District of columbia collects a state.

What Are Marriage Penalties And Bonuses Tax Policy Center

Kentucky Income Tax Rate And Brackets 2019

Gross To Net Calculator Cheap Sale 58 Off Www Emanagreen Com

Gross To Net Calculator Cheap Sale 58 Off Www Emanagreen Com

Hawaii Income Tax Hi State Tax Calculator Community Tax

Pdf Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

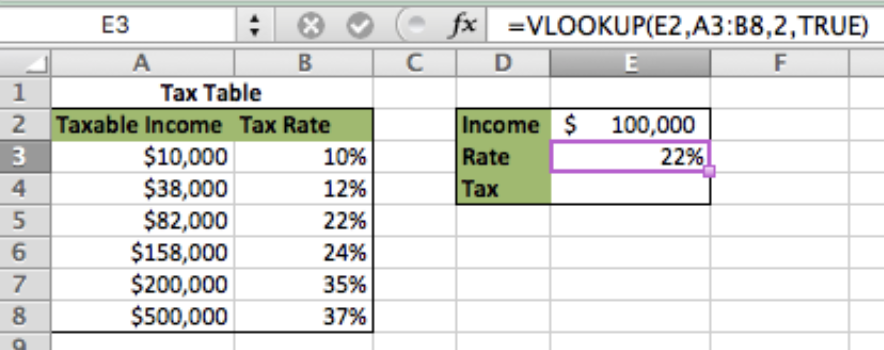

Excel Formula Basic Tax Rate Calculation With Vlookup Excelchat

Gross To Net Calculator Cheap Sale 58 Off Www Emanagreen Com

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Us Tax Calculator Discount 53 Off Farmaciamorales Cat

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Pdf Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Income Tax Calculator Estimate Your Refund In Seconds For Free

Gross To Net Calculator Cheap Sale 58 Off Www Emanagreen Com

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap